5 most common methods of startup valuation

The strategy, attractiveness of the industry and the ability of the founders replace the traditional investment judgment. How do we valuate the impossible?

Andrej Dolenc

Financial Consulting Project Manager

6. May 2021

Lately startup valuation is a very popular topic in which there are large differences as far as the evaluation methodology itself is concerned. The value of startups is methodologically almost impossible to determine, as they have a high probability of downside in the coming years, and at the same time it is extremely difficult to predict the value if the startup is to succeed (upside). It follows, that the traditional methods of predicting the company's future cash flows, which are then discounted on the valuation date, are not the most appropriate, as we do not know what the cash flows will be neither do we know how risky this forecast is. The methods that compare the achieved multiples of companies on the stock exchange and apply them to the generated results of the startup (perhaps the startup does not generate revenue at all or generates a loss) are even less appropriate. Before embarking on methods of startups valuation, let's look at the startup investor’s logic, as this is the only way to understand the problem of valuing individual startups, and why some startups achieve dizzying values in practice.

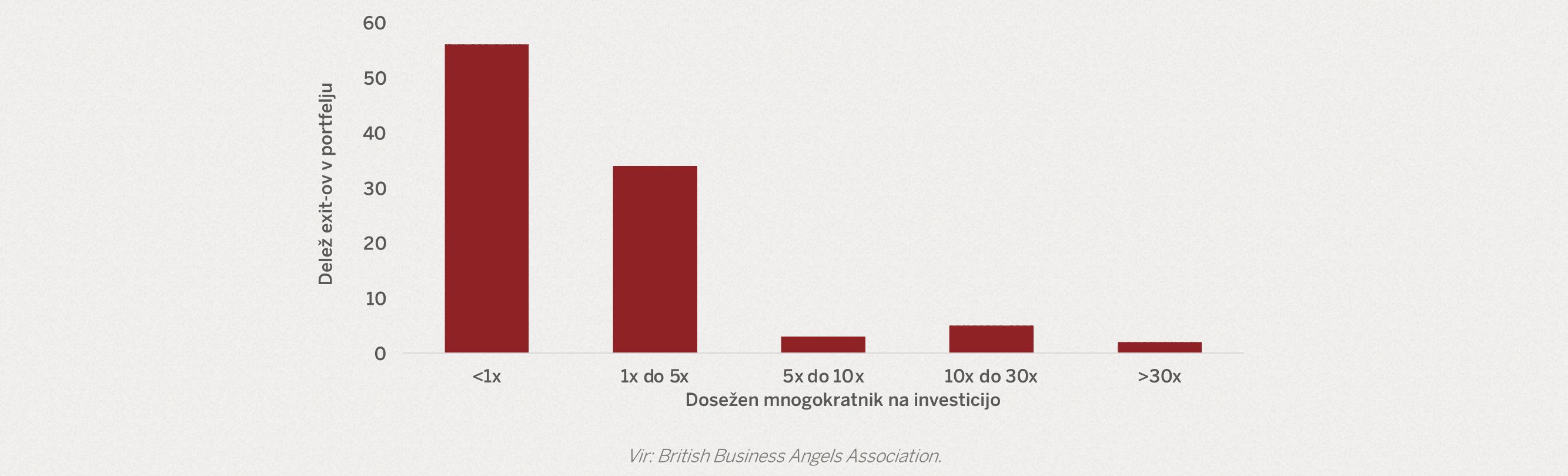

Investors who invest in startups (so-called venture capitalists or VCs) have their own investment logic, which follows the rule that the success of individual investments is not so important. It is essential that only a certain proportion of the investment in the total portfolio succeeds, generating several times the return. The best VCs are those that have a large portfolio, among which there are a huge number of unsuccessful startups and a few (maybe even just one or two) mega successful startups, the so-called unicorns. Worse performing VCs are those that have some relatively successful startups in their portfolio (which otherwise generate decent sales or cash flow) but don’t have chart-topping companies that would generate 10x or more return on investment. The distribution of VSs is similar to the graph below.

Investments in unicorns return so much money that they can “finance” investments in other less successful startups. Thus, an individual investment is not necessarily assessed according to some theoretical "internal" value of the company, as is mostly the case on the stock exchange, but according to the strategy of VCs and individual characteristics of startups. In addition to the above, the value is most often influenced by the bargaining power of both parties, the founders and investors. What increases the bargaining power of the founders are the attractive industry in which the startup operates, past investments in startups, history, experience and ingenuity of the founders and the number of investors competing for the same startup (demand). On the other hand, the value of a startup is reduced by an unattractive industry, founders with no previous experience, lack of interest from other investors and similar factors.

If VCs are interested in startup investment, but do not have a sense of how much the approximate value of a startup could be, they have some quick evaluation models available. These models are merely a tool for decision-making processes, but they are certainly not an indicator of the “internal” or “true” value of a startup, as it is impossible to calculate it.

There are several methods for evaluating individual startups, but only the most common or well-known ones are listed below.

1. Risk Factor Summation method

The RFM method is only applicable to companies that do not yet generate significant revenues and that raise “pre-seed” capital. It is based on 10 risks of an individual company, which the investor evaluates with a scale from -2 to 2 (high risk to risk-free) based on the impressions of the startup through interviews and a pitch-deck. Assessing these leads to the sum of risks, which is weighted and multiplied by the average value of the "pre-seed" startup. The average value of a startup is not quantified and depends on the type of investor, market, etc. The RFM method is used primarily as a reminder of all possible startup risks, and offers the investor a tool to assess startup’s potential and risks. However, it is not the most analytical method. Much of the calculated value depends on a certain average value of startups.

2. Scorecard Valuation method

The SV method is essentially a modified RFM method, with the difference that the risks are described slightly differently (the method has 14 specific risks). Also, the weighing scale is different. It is intended for “pre-seed” investments, and again, a large part of the obtained value depends on the input of the average value of startups. It can be significantly higher, for example, on the American market, but in Slovenia it can be significantly lower.

3. Venture Capital method

The VC method is a simple calculation of the value of the startup at a predetermined amount of investment, the amount of exit (estimated selling value of the startup at IPO or future sale), the target return on investment (usually between 10 - 30x) and the expected dilution (dilution of the investor in subsequent capital investments). From the above data, we then calculate the value of the startup and the share required by the investor for the said investment.

4. First Chicago method

The FC method works on the principle of three scenarios, namely optimistic, realistic and pessimistic. For each of the scenarios, we determine the probability of realization. The main assumptions are the discount rate (desired annual return of the investor), prudent time to exit, the amount of sales revenue or EBITDA indicator in the year of sale and multiples of listed companies from the industry in which the startup operates. With the help of multiples, we calculate the amount of exit, which is discounted to date for all three scenarios. We then calculate the weighted average of all three scenarios according to the probability of realization.

5. Real options valuation method

Valuation with real options is the most demanding method and requires quite a bit of knowledge of statistics and financial mathematics. However, this method has an important advantage, namely it takes into account and evaluates flexibility, which in turn contributes to a more realistic value of the company. So if we have a company whose future is uncertain, it makes sense to consider including real options in the valuation. The two most well - known options valuation models are the Black - Scholes model (which is mainly used in valuing financial options) and the binomial model (which is simpler and is used more often in practice when valuing startups).

As already mentioned, these methods are used to assess the value of individual startups, but are not accurate and are highly dependent on the view of the appraiser. We could more accurately estimate the entire portfolio of startups using financial math, which is a topic for some other blog post.

If an individual startup is assessed in the role of a certified appraiser, the methods are very limited due to the limitations of the Slovenian Institute of Auditors. As a result, the discounted cash flow method is mostly used. In this method, special attention should be paid to the determination of WACC (rate of return), which can strongly influence the final value. Return rates range from 30% (for startups with already approved business models) to 70% (startups without MVP and spoiled business model and no revenue). It is also desirable to use several scenarios for forecasting the income statement, and to analyze the sensitivity to the main assumptions that the reader or user of the valuation can create an image of the value of the startup.

We are an ideal partner to entities with a long-term business success vision, who want to conquer challenges and prosper.

Contact us