Risk free rate – which approach to use and why?

Which measure do we use when a bond is negative? Spot or average yield to maturity?

Andrej Dolenc

Financial Consulting Project Manager

6. October 2021

In the last few years, there has been a lot of discussions in the financial world and especially among company appraisers regarding the calculation of the discount rate with which we discount the cash flows of the assessed company. Most blood is shed in determining the risk-free rate of return, as this can significantly affect the calculated final value, and thus the final value of the company.

According to financial theory, a risk-free rate of return is the return that investors expect in order to give someone the right to use their capital with zero risk of default or loss. In most cases, the yield to maturity of the bond with the lowest credit risk or the best credit rating is used. In practice, this means that if we are assessing a company registered and operating in Europe, we use a German government bond. There are two framework approaches, namely:

- spot yield (on the day of evaluation),

- or the average yield to maturity of the previous period (e.g. 5 or 10 years).

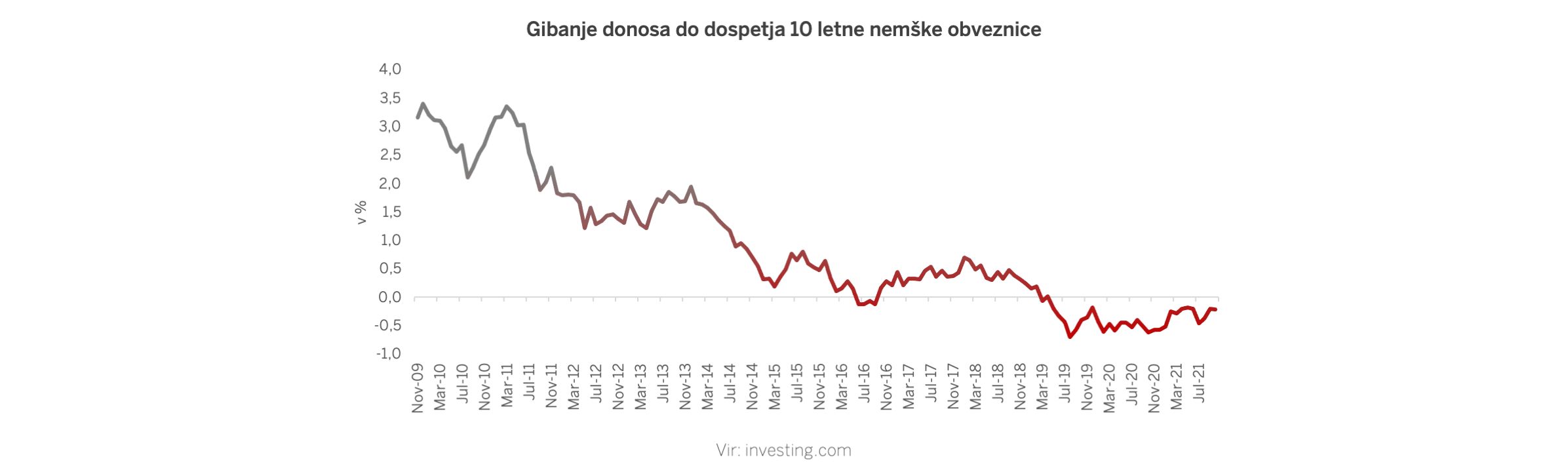

Since the yield to maturity of a 10-year German (and of course American) bond has fallen sharply over the past 10 years, and even turned negative, the question arises as to which methodology to use to calculate the risk-free rate of return, since it has a relatively significant impact on the final value of the discount rate.

The reason for using spot yield follows the logic that the appraiser uses current market factors and determines the value of the company on a specific day. If the risk-free rate of return increases significantly overnight, this also means that the assessed company is less valuable overnight, even though the company will generate the same cash flows in the future. It is not so simple, as it may (depending on the calculation methodology) also change the capital risk premium (ERP), which could offset the increase in the risk-free rate of return (although the correlation between the risk-free interest rate and ERP is not high, moreover there is apparently none after 2008). More about ERP calculation in the following blog post. If the ERP remains the same, the value of the company would be lower.

Some appraisers argue that the intrinsic value of a company is assessed, which in practice means that the value of a company should not change significantly based on external factors. Proponents of intrinsic value thus use average past yields to maturity, which is supposed to be the most relevant indicator of future yields to maturity. This begs the question of how many years it makes sense to use in averaging. Is it 5 years, 10 years, maybe 15? Each period brings a completely different value. In this way, however, the logic of intrinsic value loses its meaning, as it depends on the choice of data. Also, the assumption that yields to maturity will be similar to past ones is questionable. Some time ago, many believed negative interest rates would only be short-lived. After just under three years of negative interest rates, this assumption turned out to be untrue.

In my opinion, it would be reasonable to take into consideration only current situation in the markets, and thus spot data on yield to maturity. Intrinsic value as such seems to me an interesting concept, especially in the case of investing in the stock market, but in practice the calculation of intrinsic value is, at least objectively, impossible and as such less reliable. By using market data on the valuation date, the data is more or less known, thus gives less opportunity to manipulate the calculated market price.

For further discussion on the use of different parameters in company valuation, you can write to me on Linkedin.

We are an ideal partner to entities with a long-term business success vision, who want to conquer challenges and prosper.

Contact us